Financial fraud, scams and identity theft

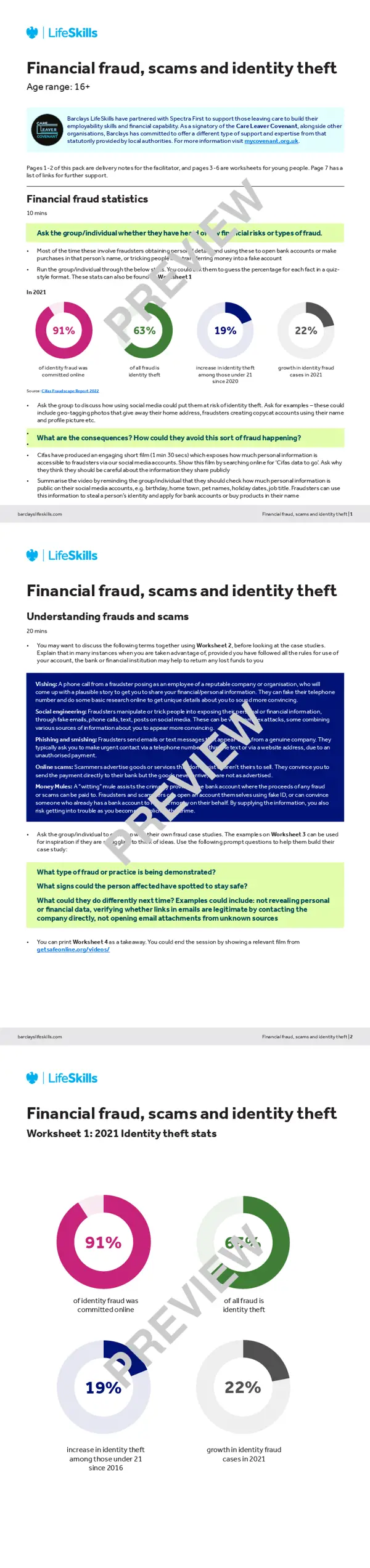

This activity pack explores different types of fraud and identity theft, such as phishing, social engineering, online scams and money mules, as well as how young people can protect themselves from becoming a victim of financial scams. It also includes a number of scenarios to get participants looking at practical, relevant examples of how financial fraud can occur, as well as the ways they can avoid it.

Learning outcomes

By the end of this lesson, students will be able to:

- Explain how using social media could put them at risk of identity theft

- Understand the consequences of different types of financial fraud

- Define and understand key fraud terms

- List top tips for staying digitally safe

- Identify a number of websites and sources which they can use to get further advice and support on protecting themselves from financial fraud

- Demonstrate an ability to respond to real-world situations involving financial fraud with practical advice and knowledge

To access worksheets for all twelve activity packs in one place, use our ‘Setting yourself up for financial independence’ workbook.

Other LifeSkills lessons are also suitable for use with care leavers to support them on their employability journey, here are some to get started with:

As a signatory to the Care Leaver Covenant, LifeSkills created with Barclays have worked directly with young people who have experienced care as well as the adults supporting them to create twelve activities adapted from existing financial education content. Activities include case studies, quizzes, discussions and practical tasks to build skills, knowledge and confidence, and can be delivered one-to-one or in a small group. Each pack includes guidance for support workers, worksheets for young people and useful signposting. Young people can register on LifeSkills to access further interactive resources on managing their money and building skills for the world of work here barclayslifeskills.com/young-people.

A free account gives you access to all educator content, tools and resources

Already have an account?

Log inGet started

Thank you for liking

Help us to continue creating relevant content for you by leaving some additional feedback.