Saving money and sticking to a budget

Helping your child understand how to save money and stick to a budget when they’re young can help their relationship with money in later life. By understanding the money they have coming in (income) and balancing it with the money they are spending (outgoings or expenditure), they can start to make the most of their money. This is a great time to encourage them to save money where they can, so they’re prepared for any financial dilemmas life may throw at them.

You can work through these money-focused activities with your child to help them understand the importance of working within a budget. Don’t worry if you’re not an expert, just follow the pointers below, or they can complete the worksheets provided independently.

What is a budget and who is it for?

Start by asking your child what they think a budget is. Explain that it is a plan of how someone will spend their money. It’s useful to chat through how prices can increase or decrease, which could mean they can buy less or more with their money. It should include all the ways money will be received or spent, and cover a set period of time (usually a week or month).

You could be open about your own experience of managing a budget. Has the cost of living crisis changed your household budget? You may have examples to share on increased electric and food costs, which meant that you reduced your spending elsewhere? It’s a good way to chat about the reality of how changing costs can have an impact on spending priorities, which then alters the budget.

Discussing and involving them in open conversations at this stage in their life, can help them to feel comfortable in chatting through any fears and challenges they have in the future.

Using the worksheet, get them to think of some examples of income they might have now or in the future, such as a part-time job, pocket money or birthday money. Then ask them what they might want to spend this money on, for example a new computer game, clothes or a meal out. Highlight that a budget can help them make sure they have enough money for the things they want to buy or may need at some point.

It’s good for your child to be thinking a few years ahead. From learning to drive to moving into their own home, a budget will come in useful for their late teens and in adulthood. Whatever stage of life they are in, they need to consider whether a purchase is essential (a need) or simply something they like the idea of having (a want).

You could discuss the concept of debt with your child, and explain that without a budget they might get into it. For example not staying on top of payments to online stores, paying off loans or credit cards. Mastering a budget can help them plan for their short and long-term plans, whether that’s new clothes, a car or something else in the future.

Budgeting examples

Now that your child understands what budgeting is and why it’s important, they can have a go at creating a budget using Chris and Ahmed’s situation below. If they are earning their own money already they could create their own budget using our template.

For Chris’s situation, ask them to complete the budget table on the worksheet. You can check through it together and make sure they understand the key terms being used such as:

· Expenditure – the amount of money spent

· Income – the money received

· Balance (positive or negative) – total income minus total expenditure

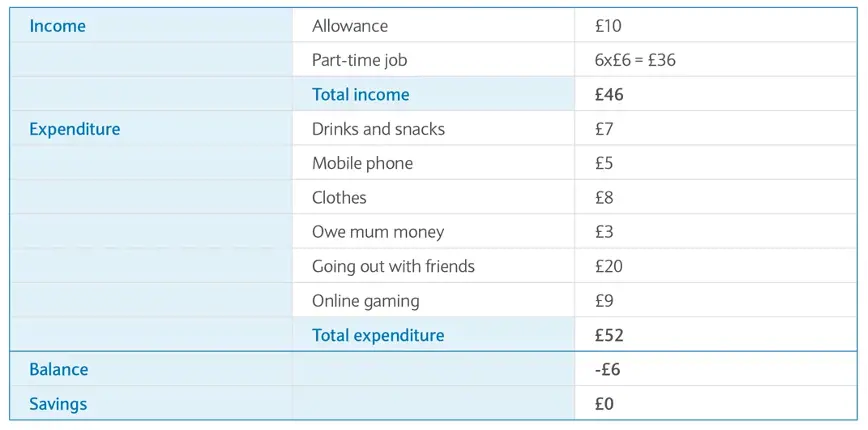

Chris’s weekly budget answers:

For Ahmed’s situation, he is ready to start work so the budgeting considerations are different to Chris’s. There is a spending guide to help but not everything will apply to Ahmed. It’s useful for your child to understand other things that might apply to them in the future.

Make sure they have considered Ahmed’s weekly, monthly and yearly incomings as well as expenditures, such as:

· Living costs including accommodation, food, bills and clothes.

· One-off costs such as a new laptop

· Travel for example petrol or train fares

· Leisure which might include cinema or gym

Budgeting could be a fun activity for your child to get involved in at home. From how many essential food items on your weekly shopping list they can get for £20 to comparing different prices for car or home insurance, there are lots of opportunities for them to be budgeting in everyday life.

These are all things they will do for themselves one day, so it’s great to get them considering what is essential and how to prioritise.