Your money and your life

As you grow older you’ll tend to earn more, but your spending will probably go up too. Carefully weighing up your needs and wants at each life stage will make it easier to plan ahead when it comes to those big financial decisions.

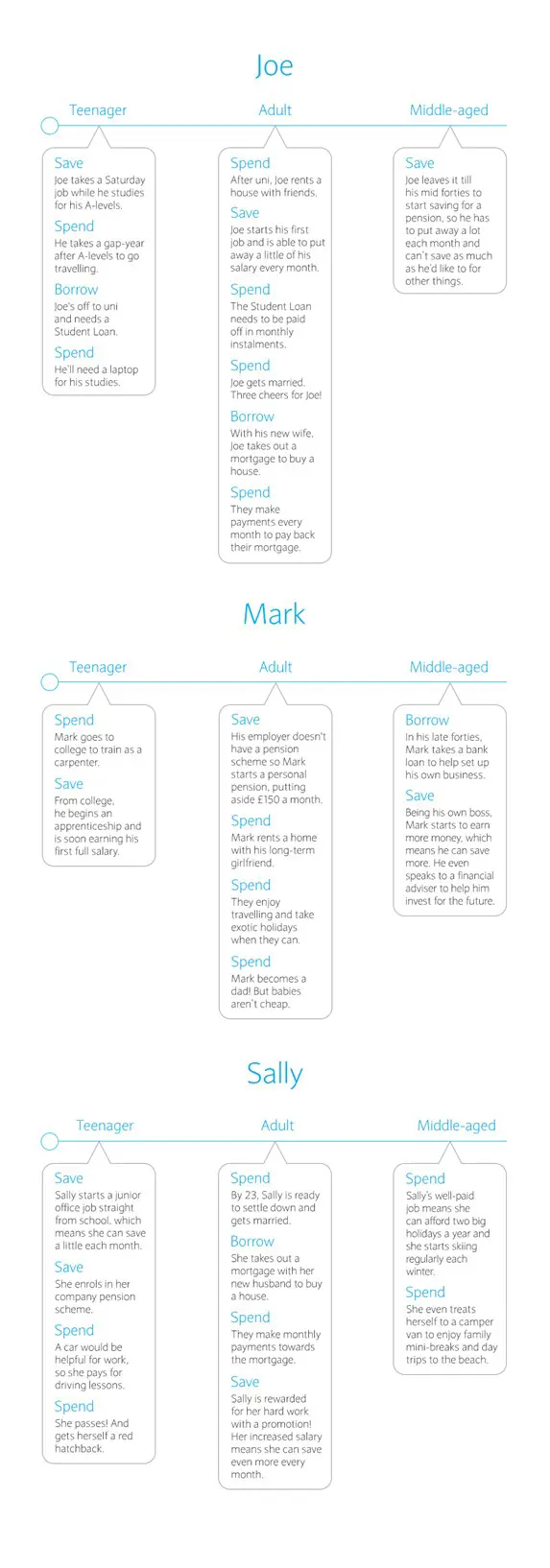

Take a look at how Joe, Mark and Sally spent, saved or borrowed at certain stages in their lives. Notice how decisions they make in one life stage have a knock-on effect in later ones.

It’s important to think about your needs and wants as you take your first steps into the world of work. But what about those things you know will become more important as you get older? The parts of your life when your priorities will probably change can be divided into chunks called ‘life stages’.

Where will life take you?

Take a look at the five main life stages below and think about some of the things you might need and want as you move through the ‘Young adult’, ‘Middle age’ and ‘Old age’ stages. We’ve included some examples.

Childhood → Adolescence → Young adult → Middle age → Old age

“I definitely want to learn to drive soon, and I don’t want to give up my season ticket for the football, but I also know I’ll need to take out a student loan and find a flat to rent when I go to uni.”

Carl

“Things are OK at the moment – I love shopping and going out with my friends. I know when I start work I’ll need to start a pension. And I really want to get married someday too.”

Izzy

“My gym membership isn’t cheap, and I love adding to my trainer collection. I know I need to start saving though – I need to buy a laptop for my college work and I want to start saving as soon as possible for a deposit on a house one day.”

Tom

It’s important to remember that:

- You’re going to reach these points in your own life

- Your needs and wants will change at each stage

- Somehow, you’ve got to pay for them

Making the big decisions

When thinking about how you’ll pay for things in the future, your choice probably comes down to a few options:

- Save up in advance

- Invest for the long term

- Borrow the money and pay it back, with interest

These choices can impact your ability to spend, save or invest for a long time. Splashing out on a new phone is one thing, but something like buying a house is a decision that can affect you for years and having enough money for your retirement may feel a long way off, but future you will thank you for thinking about it earlier in life.

Planning your future

Thinking ahead helps you spot the things you need to plan for, so you’re ready to make the right choices about what to do and how to pay for it.

Try asking yourself these helpful questions:

- What are the next stages in your life?

- What are the stages in your life which are way off but could be useful to think about?

- What might your needs and wants be?

- How much are they going to cost?

- What will be the right way to pay for these choices... and when might you need to start?

Find more information on borrowing, investing, pensions and saving to help you further with the different life stages.