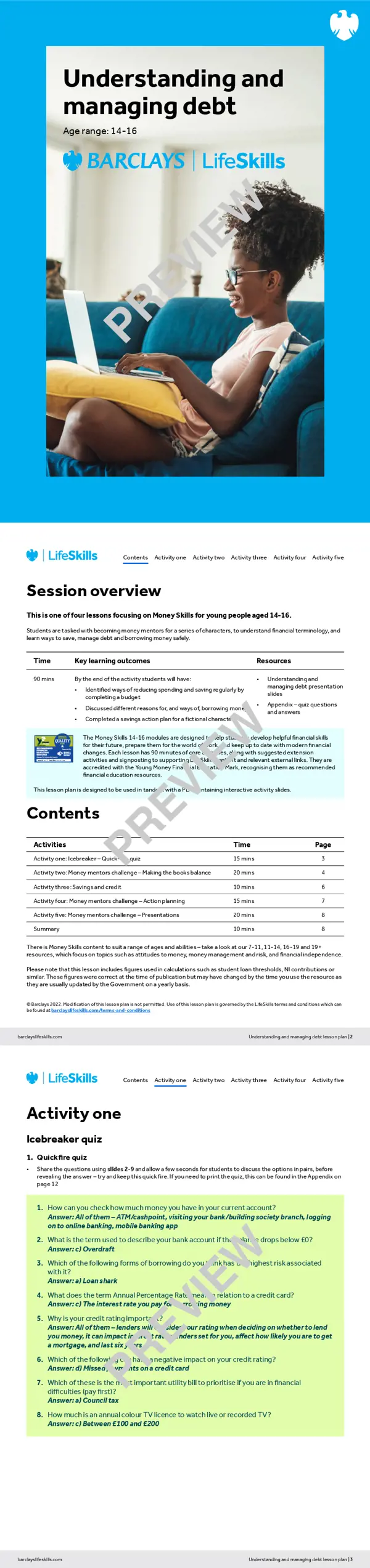

Money skills lesson one: Understanding and managing debt

Helping young people with money skills, such as understanding debt and using credit, can help set them up with good money habits for the future. The activities on this page allow students to develop these skills in a variety of ways, whether you’re looking for short activities or something more in-depth:

Teaching resources:

- Understanding and managing debt: Lesson plan and presentation slides –full lesson plan for use with a group of students in the classroom

- Saving money and budgeting: Interactive worksheet – activity for independent learning whether remote or in class

How can you use these activities with your students to improve their budgeting skills?

These activities focus on improving students’ understanding of budgeting and how life choices can impact on a person’s finances. They include scenarios that allow students to become ‘money mentors’ and practise balancing the income and expenses of characters in different financial situations.

Lesson plan

(60 - 90 minutes)

This is lesson one of four focusing on Money Skills for young people aged 14-16. This lesson is designed to particularly help students consider the advantages and disadvantages of using credit when compared to saving to make purchases.

To ensure that the lesson plan and student-facing interactive PDF work together smoothly, please make sure you download and save both documents into the same folder on your computer.

Lesson learning outcomes

By the end of the lesson students will be able to:

- Identify ways of reducing spending and saving regularly by completing a budget

- Discuss different reasons for, and ways of, borrowing money

- Complete a savings action plan

How can this lesson further your students’ understanding of credit and borrowing?

It explores savings and credit, particularly the difference between using each to make a large purchase. Through interactive activities, reflection and discussion they will consider different situations in which a person might borrow money. Additionally, the activities explore the money worries and dream items of a group of characters, and then work in a group to create an action plan for each. The lesson also includes the opportunity for students to share their plan to the class through a presentation.

Interactive worksheet

(15 to 20 minutes)

Please note that students below the age of 14 cannot sign up for their own LifeSkills account. Any independent tasks must be printed or downloaded and provided digitally for them to complete as they are currently hosted on educator pages.

Students can use the Saving money and budgeting interactive worksheet to understand how to create a budget that tracks their own incomings and outgoings and identify their spending and saving habits.

The worksheet contains some of the themes from the full lesson and can be printed or completed digitally. You may like to assign this activity:

- As homework following the Understanding and managing debt lesson

- For independent study

- For remote learning

Further support for developing students’ money skills

Follow this lesson on with the remaining three money skills lessons for this age group, which cover Money and work, Financial risk and security and The future of money. Why not build financial capability as a focus in your wider curriculum? Refer to our Content guide to find out how this LifeSkills resource can be used in PSHE or Maths lessons.

Bring the topic of credit and debt to life further by watching these BBC Teach films, where Steph McGovern takes a look at the ways in which money can be borrowed and how interest works.

If you want to increase your own confidence to teach young people about money, Young Money provide free e-learning training to teachers across Primary and Secondary education. In addition, National Numeracy has a free website which helps you practise and refresh your everyday maths skills.

A free account gives you access to all educator content, tools and resources

Already have an account?

Log inGet started

Thank you for liking

Help us to continue creating relevant content for you by leaving some additional feedback.