Care leaver suitable: Self-employment

This activity pack aims to help young people explore what it means to be self-employed or work as a freelancer or sub-contractor. It delves into the main considerations and facts of self-employment, including top tips on the legal requirements and tax considerations when working for yourself. It also includes a scenario to help young people explore a real-world, practical example of the advantages and disadvantages of being self-employed.

Learning outcomes

By the end of the lesson, students will be able to:

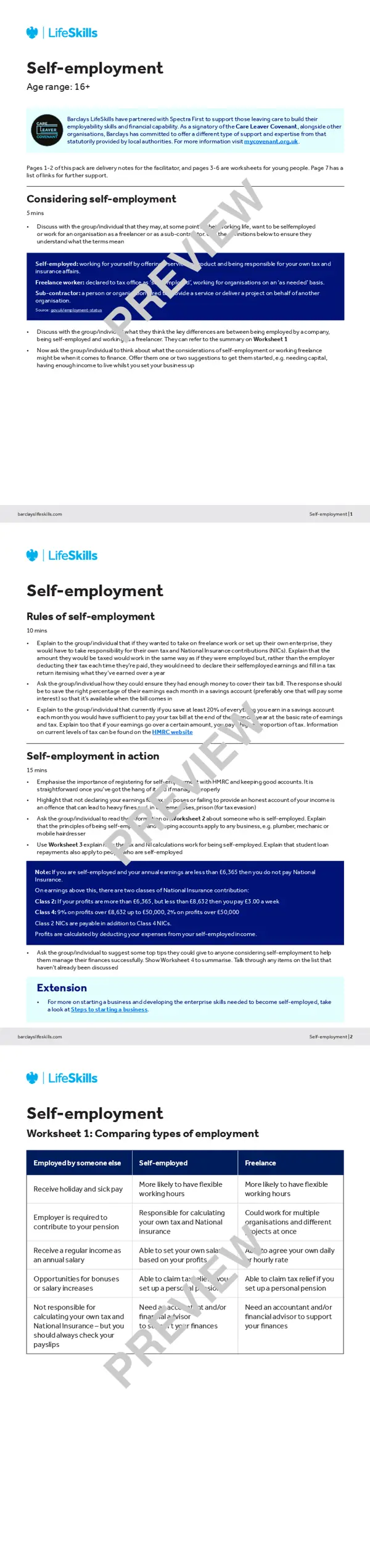

- Define the different types of employment, including being self-employed, employed by someone else, working as a freelancer and becoming a sub-contractor

- Consider the advantages and disadvantages of being self-employed

- Understand the potential financial implications of becoming self-employed, including taking responsibility for tax and National Insurance contributions

- Understand the importance of registering for self-employment with HMRC and keeping good accounts

To access worksheets for all twelve activity packs in one place, use our ‘Setting yourself up for financial independence’ workbook.

Other LifeSkills lessons are also suitable for use with care leavers to support them on their employability journey, here are some to get started with:

A free account gives you access to all educator content, tools and resources

Already have an account?

Log inGet started

Thank you for liking

Help us to continue creating relevant content for you by leaving some additional feedback.